This year and next, according to IMF forecasts, growth will remain stable at 3.2 percent. In the photo: fishermen in Morocco IMF: the global economy remains resilient despite uneven growth and possible difficulties Economic Development

Contrary to gloomy forecasts, the global economy remains resilient, showing stable growth. Inflation is slowing almost as fast as it previously rose. This is stated in a new report from the International Monetary Fund (IMF), published on Tuesday.

IMF experts note that the global economy has been under pressure in recent years from several factors – disruptions in supply chains after the pandemic, the energy and food crisis caused by Russia’s war against Ukraine, as well as a significant increase in inflation, followed by tightening monetary policy.

Global economic growth slowed to a low of 2.3 percent at the end of 2022, shortly after the median headline inflation rate peaked at 9.4 percent. This year and next, the IMF forecasts growth will be stable at 3.2 percent, with median headline inflation falling from 2.8 percent at the end of 2024 to 2.4 percent at the end of 2025. Most indicators continue to point to a soft landing.

Global economy

The crises of the last four years have caused less damage to the economy than expected, although estimates vary by country. US economic growth has already surpassed the pre-pandemic trend. However, in low-income developing countries, many of which are still reeling from the effects of the pandemic and the cost of living crisis, the opposite trend is expected.

Sustained growth and rapid disinflation suggest a favorable turnaround in the supply environment, including an easing of energy price shocks and a marked recovery in labor supply due to large influxes of immigrants into many developed countries. economics. Despite these favorable developments, numerous challenges remain and decisive action is needed.

Inflationary risks persist

The priority should continue to be to reduce inflation to the target level, and progress on this issue, as noted by the IMF, has slowed somewhat since the beginning of the year. This may be a temporary delay, but there are reasons to remain vigilant. “The good news on inflation comes mainly from lower energy prices and rising food prices,” Pierre-Olivier Gourinchas, economic adviser and director of the IMF’s Research Department, wrote in a blog post.

The latter, he said, was aided by easing supply chain frictions as well as lower export prices in China. But oil prices have been rising recently, driven in part by geopolitical tensions, and service sector inflation remains stubbornly high. New trade restrictions on Chinese exports could also push up commodity prices, Gurinsha warns.

Deepening economic differences

The US’ recent strong performance has been driven by robust productivity and employment growth, as well as strong demand in an economy that remains overheated. This requires the Federal Reserve to take a cautious and gradual approach to policy easing, writes an IMF economist.

Growth in the eurozone will recover, but from very low levels, as previous shocks and tight monetary policy weigh on activity. Continued rapid wage growth and persistent service sector inflation could delay inflation’s return to target.

Global economy

“However, unlike the US, there are few signs of the economy overheating so far, and the European Central Bank will need to carefully adjust its move to ease monetary policy to avoid setting inflation below target,” says Gurinsha.

China’s economy continues to be affected by the slowdown in the real estate sector. Booms and busts in the credit industry never resolve themselves quickly, and this case is no exception. Domestic demand will remain weak unless its underlying causes are addressed through decisive action. In conditions of reduced domestic demand, the external surplus may well increase. There is a risk that this will further escalate trade disputes in an already tense geopolitical environment.

Many other major emerging markets are performing strongly, sometimes benefiting from the change configurations of global supply chains and intensifying trade disputes between China and the United States. The influence of these countries on the world economy is increasing.

Policy course

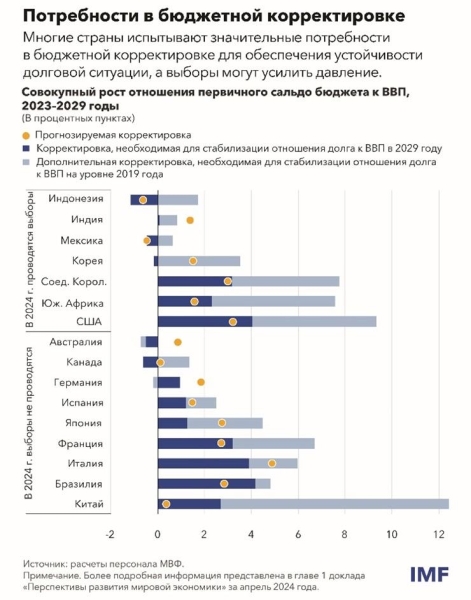

The first priority is to restore budget reserves, according to IMF. Despite the decline in inflation, real interest rates remain high and sovereign debt dynamics become less favorable.

The second priority is to reverse the deterioration in medium-term economic growth prospects. Structural reforms aimed at stimulating domestic and foreign direct investment, as well as strengthening domestic resource mobilization, will help low-income countries reduce borrowing costs and reduce financing needs.

Read also:

INTERVIEW | Despite the war, the economies of the post-Soviet region are growing

Artificial intelligence also offers hope for increased productivity. However, there is a high likelihood of serious disruption in the labor and financial markets. Harnessing the potential of AI everywhere will require countries to improve their digital infrastructure, invest in human capital, and agree on global “rules of the game.”

Medium-term economic growth prospects are also adversely affected by increased geo-economic fragmentation and a sharp rise in trade restrictions and industrial policies. As a result, trade relations are already undergoing changes, which may cause inefficiencies. This could lead to the global economy becoming less, not more, sustainable. More broadly, however, the damage is being done to global cooperation. It is not too late to reverse this process, an IMF specialist notes.

Thirdly, he said, the big achievement of the last few years has been the strengthening of monetary, fiscal and financial policy frameworks, especially in emerging market countries. It is extremely important, the IMF warns, to maintain these improvements in the future. This includes protecting the independence of central banks.

Transition to a green economy

The transition to a green economy requires large investments. Reducing emissions is compatible with economic growth, and the intensity of emissions associated with economic activity has declined significantly in recent decades. However, emissions continue to rise. Much still needs to be done.

In advanced economies and China, green investment is growing at a significant pace. The biggest effort now must come from other emerging market and developing countries, which must significantly accelerate the growth of green investments and reduce investment in fossil fuels. This will require technology transfer from other advanced economies and China, as well as significant private and public funding. “Multilateral mechanisms and cooperation remain critical to achieving progress on these and many other issues,” says the Director of the IMF Research Department.